Press play to listen to the course introduction:

Now that you have completed step 1 and saved your £1000 emergency fund in your fixed rate interest paying account, you’re ready to tackle step 2 and pay off your debt.

Good and bad debt?

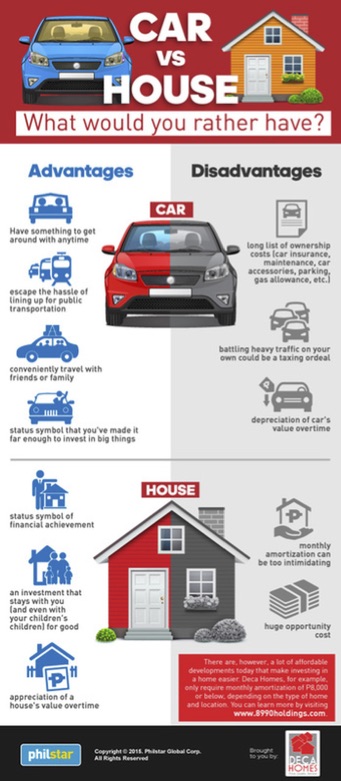

There are two types of debt, good debt is buying a home with a mortgage which you can enjoy every day. Bad debt is reaching for the latest technology when last years technology is still very usable.

”A little-known secret is that we should avoid keeping up with the Joneses because the Joneses are likely in debt.”

TIP: If you are serious about getting out of debt then you must get control of your spending, and I suggest leaving your credit card at home so you cannot use it.

In baby step 1, we have put in place several good budget practices, we can now focus on reducing our debt.

Using the Dave Ramsey debt snowball method is a great way to knock out your debts one by one and becomes very motivating when you see the progress being made each month.

Step 1) List all your debts except for your mortgage/rent by balance, smallest to largest. Don’t worry about interest rates unless two commitments have similar amounts, then you’ll list the higher interest rate debt first.

For example, let’s say that you have four debts that you’d like to clear;

a) Bank overdraft of £2000 at 15.9% interest = £50 minimum.

b) Credit card debt of £3000 at 22.9% interest = £90 minimum.

c) Personal loan of £5000 at 9.9% interest for five years = £105 minimum.

d) Student loan of £30,000 at 6% interest until paid off = £30 minimum.

Step 2) Attack the first balance on your list by paying as much as you can each month while making minimum payments on your other debts.

So taking the £600 from the example budget in baby step 1, we would work on paying the maximum we can afford on the smallest debt namely the overdraft while making the minimum payments to the others.

£600 – Credit Card £90 – Personal Loan £105 – Student Loan £30 = £375 for the overdraft, which would mean that you would have paid it off within seven months and saved a lot of interest.

TIP: Having an overdraft is only advisable if your bank offers an interest-free one. Otherwise, it is best to decline it and keep control of your budget.

Step 3) When you’ve paid off the overdraft, add the £375 that you were paying to the credit card £90 payment for £465 total to your next debt and start attacking it. This would mean that your credit card would be paid off in eight months.

TIP: In the past, I’ve used a 0% balance transfer card to move high credit card debt to another card and temporarily freeze the amount of interest paid, although this should only be done if you intend to pay off the credit card altogether. There’s no such thing as a free lunch, and there is often a charge of 1-3% for the balance transfer, which will be added to the new card balance. These offers are usually time-limited but as we intend to get out of debt, 18-24 months should be sufficient for most cases.

Step 4) When you’ve paid off the credit card, add the £465 that you were paying to the bank loan £105 payment for £570 total to your next debt and start attacking it. This would mean that the bank loan was paid off very quickly.

Step 5) When I was younger, we did not have student loans, and so I’ll leave this option up to you as to whether you pay it off earlier or not. From my research, once you earn past £25,000 per year, your employer will automatically deduct 9% from your salary each month to repay your student loan. My recommendation is to consider what is more important at this stage because not only will you have your £1000 emergency fund, but also be almost debt free 🙂

Okay, now that we have our debt under control, let’s continue improving your financial education and please leave comments in the comments section below.

Jeff

Recent Comments