Press play to listen to the course introduction:

Now that you have completed step 1 and saved your £1000 emergency fund in your fixed rate interest paying account, you’re ready to tackle step 2 and pay off your debt.

Good and bad debt?

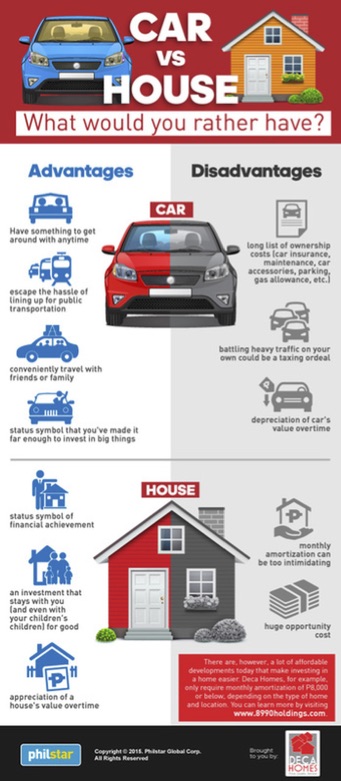

There are two types of debt, good debt is buying a home with a mortgage which you can enjoy every day. Bad debt is reaching for the latest technology when last years technology is still very usable.

”A little-known secret is that we should avoid keeping up with the Joneses because the Joneses are likely in debt.”

TIP: If you are serious about getting out of debt then you must get control of your spending, and I suggest leaving your credit card at home so you cannot use it.

In baby step 1, we have put in place several good budget practices, we can now focus on reducing our debt.

Using the Dave Ramsey debt snowball method is a great way to knock out your debts one by one and becomes very motivating when you see the progress being made each month.

Continue reading

Recent Comments